- IN THE NEWS X

- How To Make Your Income Tax-Free Even After Earning Rs. 10 Lakh In FY 2022-23?

- Seniors need to submit Forms 12BBA, 15G, 15H to save on TDS: Experts

- How investing in 54EC bonds can help you save tax on long-term gains

- New income tax forms are out for new assessment year 2022-23. Find out which one you should use

- New ITR forms need income disclosure from foreign retirement a/cs

- Why is March 31 an important date for taxpayers? Find out

- Not filed ITR yet? Face penalty or even jail term, say analysts

- March 15 Is The Last Date To Pay Advance Tax: Time To Clear Your Liability

- It's time to deduct TDS if rent exceeds Rs 50,000, say analysts

- Clarification on capital gains tax on early redemption of Sovereign Gold Bonds is required – Here’s why

- Second amendment to LLP Rules will ease procedural burden: Experts

- Three Things To Keep In Mind Before Investing In RBI’s Sovereign Gold Bonds

- Tackle low liquidity in sovereign gold bonds by laddering, say analysts

- CBDT, tax tools make e-filing of I-T returns simpler

How To Interpret Form 26AS While Filing Your Income Tax Return?

Written by Gagandeep Arora - Date - 19th May 2022

If you have taxable income and file your ITR then you must be familiar with Form 26AS. It is an annual statement that has a complete overview of tax deducted at source, details of the tax collected by your collectors, advance tax paid, self-assessment tax paid, refund received from tax paid, and any high-value transactions entered by the taxpayer. The latest Form 26 AS also includes information on specified financial transactions, pending and completed assessment proceedings, tax demands and refunds besides all the present data in the form. The scope of Form 26 AS has increased over the years, this article will help you interpret it clearly.

Analysis Of Form 26AS

Form 26AS can be downloaded from the TRACES website or through the net banking facility of any authorised bank. Visit www.incometax.gov.in and log in through your login id and password. If you don’t have an ID, register your Pan primarily. Let us intersect Form26AS furthermore.

Format Of Form 26AS

This form is further divided into various parts which are namely

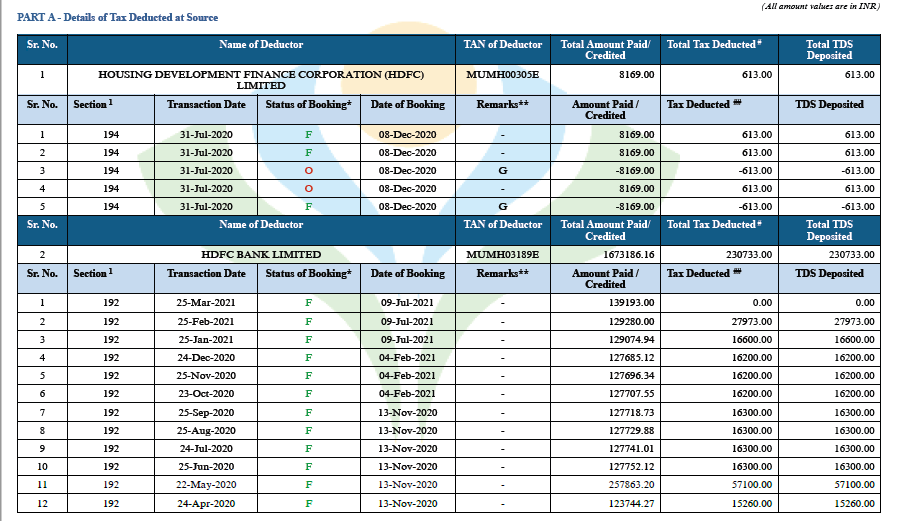

- Part A- Summary of tax deducted at source

This part covers all the details of TDS deducted on your salary, interest income, pension, lottery winnings etc.It consists of TAN of the deductor, the amount of TDS deducted and deposited to the government. This information is updated in every quarter.

- Part A1- Details Of Tax Deducted At Source for 15G/15H

Information on income where no TDS has been deducted is given here as an assessee has submitted Form 15G/15H.Verification of the status of the TDS deduction can be done if Form 15Gor Form 15H has been submitted. If there is no submission then this section will show “no transaction present”.

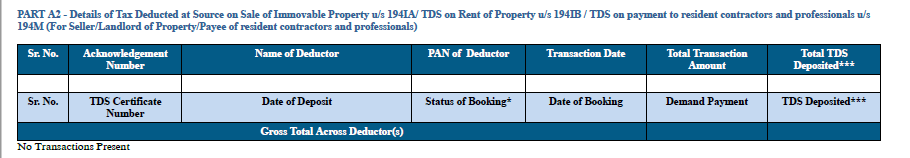

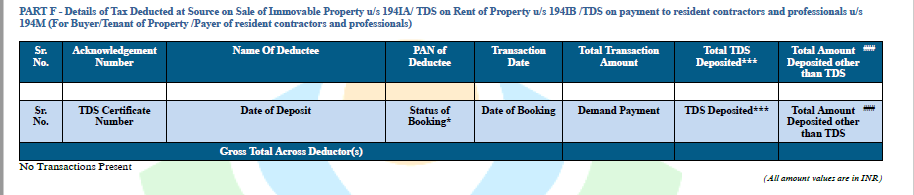

- B.Part A2- Information Of Tax Deducted At Source on the sale of immovable property under section 194(1A)/TDS on rent of property under section 194(1B)/ TDS on payment to resident contractors and professionals under section 194M.

This section shows the details if you have rented or sold ayour property. Received payments for any contractual or professional services during the year and TDS has been deducted for the same.

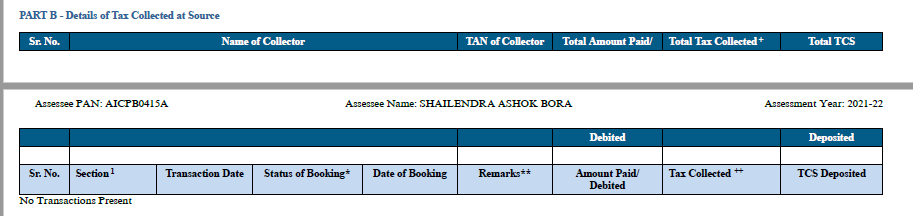

- 2. Part B- Summary Of Tax Collected At Source

This section shows the information for the seller who has collected tax from you. All the details regarding the seller who has collected tax at source from you.

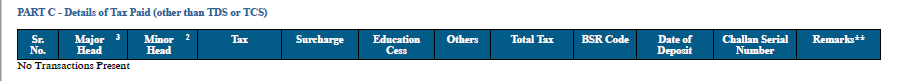

- 3. Part C- Summary Of Tax Paid ( other than TDS or TCS)

Information regarding self-assessment tax and advance tax paid by you are mentioned here along with the challan through which the tax was paid.

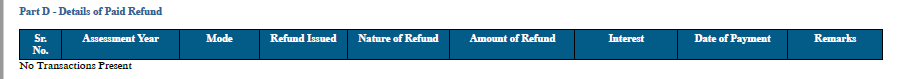

- 4. Part D-Information On Paid Refund

All the details regarding refund issued in the Assessment year are mentioned here like,the amount paid, interest paid along with the date it was paid on.

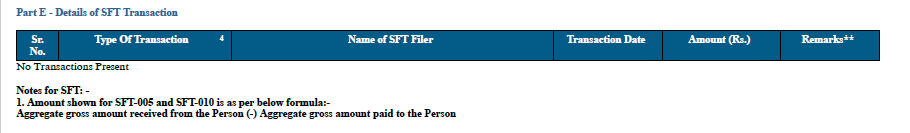

- 5. Part E- Information On SFT Transactions

High- value transactions are reported in this section by the banks and other financial institutions.

- 6. Part F-Summary Of Tax Deducted At Source on the sale of Immovable Property under section 194 (1A)/ TDS on rent of property under section 194(1B) / TDS on payment to resident contractors and professionals under section 194M This shows TDS deducted and deposited by you for any of the following purposes like property bought, rent paid, paid for contractual work or professional fees.

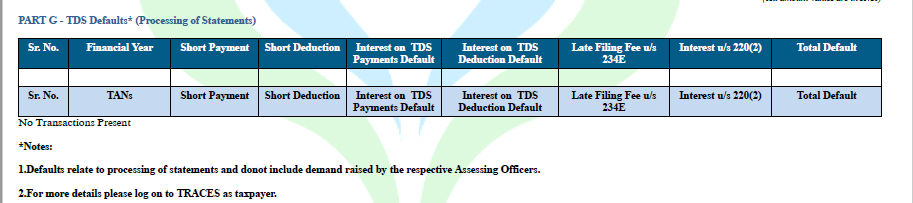

- 7. Part G- Defaults on TDS Defaults related to the processing of statements are mentioned here.

- 8. Part H- Summary of turnover as per GSTR-3B As the details of the turnover given in the GSTR-3B are mentioned here.

Conclusion- Avoid Discrepeancy

Form 26AS is an important form to assess a detailed view of the financial status of a taxpayer.It is important that the details given by the assessee are in sync with this form otherwise an intimation or notice will be issued by the income tax department to the asseessee.